Traditionally, accounting has been perceived as an ordinary and uninteresting facet of business. However, the accounting department will ensure its success as the business grows. The company's financial stability depends on giving the accounting staff the resources to monitor these variables efficiently.

Multiple accounting software options are available in the current market, each offering a variety of features and reporting functions that accountants need. But how does one go about determining which software is the best fit? An ideal solution would be accounting software that seamlessly integrates with other commercial solutions. This will lead to substantial time and resource savings for the organization.

In this blog, we have decided to analyze Accounting Software for Business and compare the leading competitors in the market, including Odoo, Quickbooks, Sage, and Xero. To assess the most commonly used accounting solutions fairly, we have created a table highlighting the key features a comprehensive accounting software should include. Here are the categories: General Accounting, Accounts Receivable, Accounts Payable, Bank and Cash, Extras, & Reporting. These categories cover a wide range of aspects essential for a company to manage its finances effectively. We have included a thorough list of each solution's pricing conditions and usability analysis.

Accounting Software for Business Comparison: Odoo, Quickbooks, Sage & Xero

Odoo

Odoo has gained popularity as a business solution by offering a straightforward and practical approach to addressing complex needs in the industrial landscape. Boasting over 82 fully integrated business applications and extensive community modules, this open-source software serves companies of all sizes and industries, establishing itself as an active player in the industry. Odoo is available in 3 editions: Community, Enterprise, & Online.

Quickbooks

Intuit, a financial software company, created Quickbooks in 1994 as an accounting software solution for small and medium businesses. In 2014, the software was divided into different options, with industry-specific features added to make it more appealing. Quickbooks has gained recognition as one of the most extensively utilized accounting software in the United States. There are two versions of Quickbooks available: Enterprise and Online. The Enterprise edition can be accessed either online through additional hosting services or locally. This comparison will demonstrate the features and functionality of Quickbooks utilizing Online Essentials.

Sage

Sage was established early in 1981 and was originally designed as a standalone accounting software solution. Over the years, Sage has experienced substantial growth, including a wider range of accounting and general business management features. Today, Sage provides diverse business management software solutions to meet the requirements of all sizes of businesses. Two editions are available: Sage One Accountant Edition for freelance accountants and bookkeepers and Sage Online Edition for small and medium-sized enterprises. With the aim of this comparison, we have chosen Sage Business Cloud Accounting to analyze its scope of features.

Xero

Xero was started in New Zealand in 2006 by a business manager and an Accountant. Frustrated with the usual installed accounting software for desktops, they made the decision to build a new tool and create their web-based solution. Since then, Xero has grown to serve the European market as well as the US market. Second, it has not ceased to develop the additional features and its capability for mobile integration. Last year, Xero was featured on the Forbes list of the 100 most innovative growth companies worldwide. Xero can only be obtained from the company through a software-as-a-service model. For this comparison, we chose the Standard Plan that the company Xero provides.

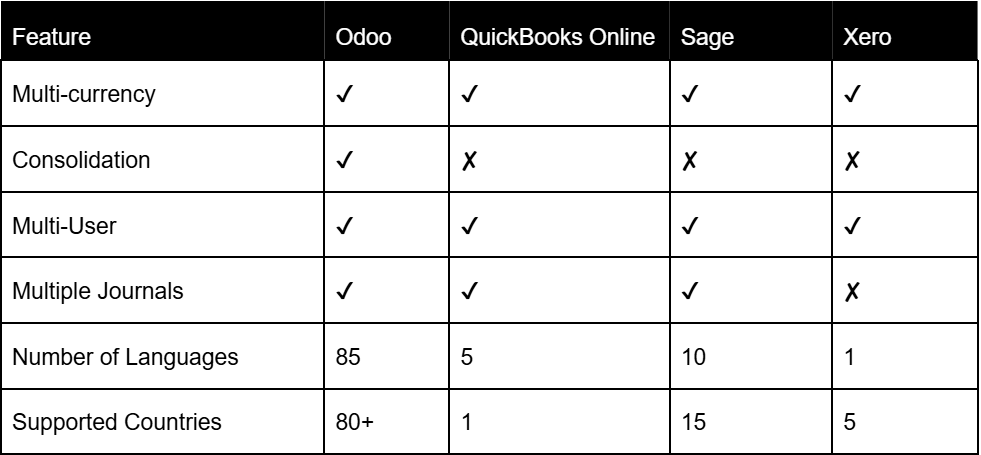

General Accounting

The table compares the features of Odoo, Quickbooks, Sage, & Xero in general accounting functionalities. Odoo offers the most comprehensive features, including consolidation, multi-currency, and multiple journals, with the broadest support of 85 languages and 80+ countries. QuickBooks Online supports multi-currency, multi-user, and multiple journals but lacks consolidation and is limited to 5 languages and one country. Sage also misses consolidation but supports multi-currency, multi-user, and multiple journals, with ten languages and 15 countries. Xero is the least versatile, supporting only multi-currency and multi-user, while lacking consolidation and multiple journals, with just one language and five supported countries.

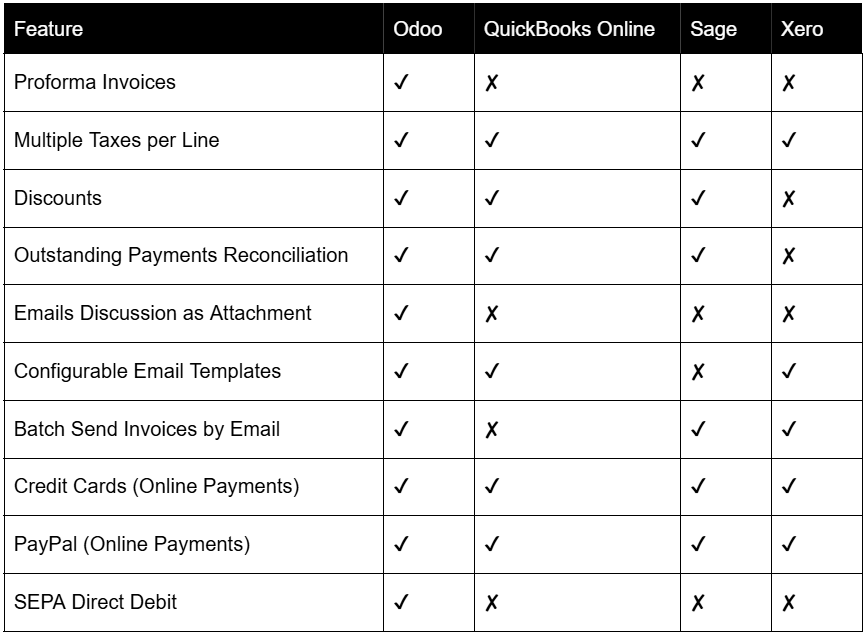

Accounts Receivable

The comparison table explains the features of Odoo, Quickbooks, Sage, and Xero in managing customer invoices, payments, and collections. Odoo stands out for accounts receivable with features like proforma invoices, email discussions as attachments, and SEPA Direct Debit, which is not available on any of the other platforms. It also supports key features like multiple taxes per line, discounts, and outstanding payment reconciliation, mostly across other platforms. However, Odoo’s added customization options, like configurable email templates and batch-sending invoices by email, provide an edge in automation and efficiency compared to QuickBooks, Sage, and Xero. Overall, Odoo offers comprehensive accounts receivable features, while Quickbooks, Sage, and Xero offer essential functionalities but may lack some of their more advanced capabilities.

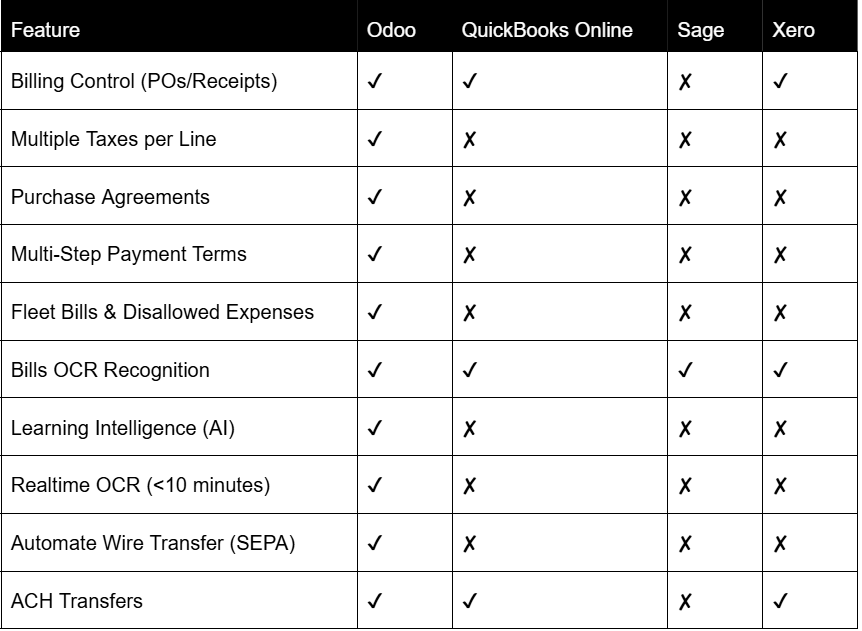

Accounts Payable

The comparison reveals that Odoo, Quickbooks, Sage, and Xero offer unique vendor bills and payment management features. Odoo provides a broad range of vendor bill management and AI-powered features like billing control (purchase orders/receipts), multiple taxes per line, and purchase agreements, which are missing in most other platforms. Its advanced capabilities, such as learning intelligence and real-time OCR under artificial intelligence, give it a significant edge in automation. Odoo also excels in vendor payments with SEPA transfers and ACH transfers, while QuickBooks and Xero offer ACH, but Sage lacks these features. In comparison, Sage and Xero are more limited, missing many of the vendor bills and AI-based functionalities found in Odoo. However, Quickbooks and Xero provide essential functionalities but can lack some of Odoo's more advanced capabilities.

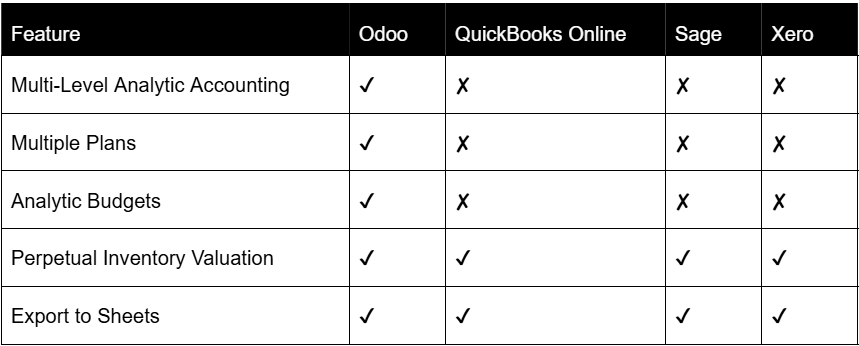

Extras

Odoo, a complete accounting solution, has more features than Quickbooks, Sage, and Xero. Auto-reconcile, AI-powered bill management, branch management, cross-analytic reporting, delayed management, and PDF attachment prioritization in invoice production are highlighted. Revenue and custom reports are also available via Odoo. It eliminates data silos and duplication by integrating smoothly with other modules. Quickbooks and Sage lack AI-driven functionality and customization, while Xero lacks Odoo's comprehensive reporting and administration tools. Overall, Odoo's "Extras" make it a complete option for enterprises that need sophisticated capabilities, customization, and interaction with other operational modules.

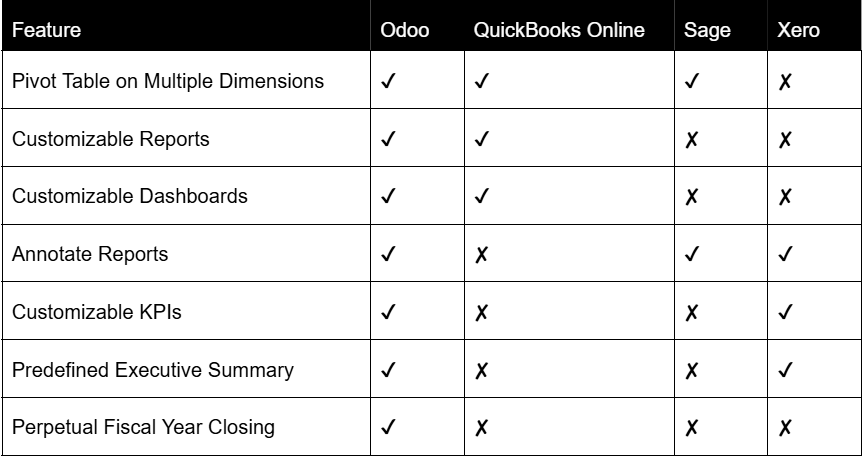

Reporting

Odoo, Quickbooks, Sage, and Xero give multiple financial reporting options. Revenue reports, customer ratings, aged receivable and payable reports, and SLA status analysis may be customized in Odoo. Visualization options include pivot, graph, and dashboard views. Odoo's reporting features let users customize displays and export outcomes to spreadsheets. Quickbooks, Sage, and Xero provide basic reporting but not Odoo's depth and flexibility. Odoo's cross-analytic reporting and insights based on AI separate it from competitors. Odoo is an ideal substitute for enterprises seeking deep financial analysis and insights.

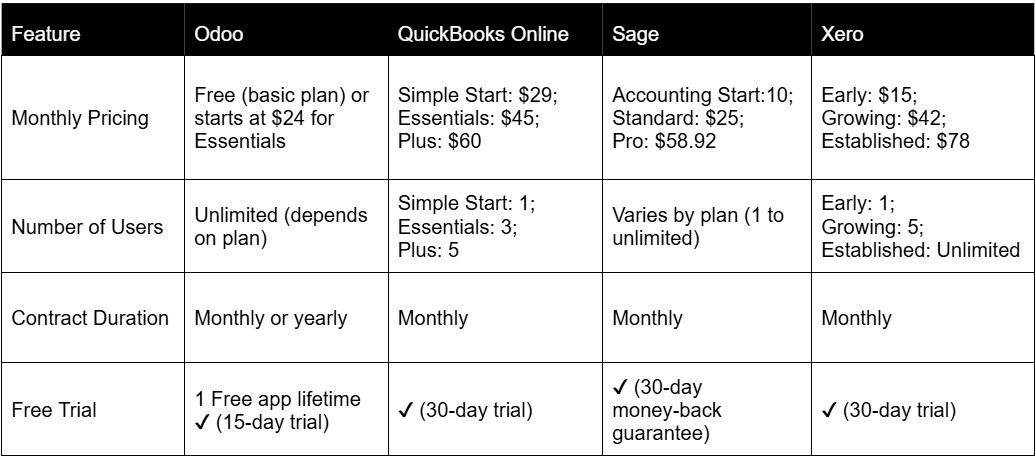

Pricing

The table compares 4 popular accounting software solutions as of 2024: Odoo, QuickBooks Online, Sage, and Xero. Odoo offers a free basic plan with unlimited users, while advanced features start at $24 per month and include a 15-day free trial. QuickBooks Online has tiered pricing from $29 to $60, supporting one to five users, with a 30-day free trial. Sage starts at $10 per month, with varying user limits and a 30-day money-back guarantee. Xero's pricing ranges from $15 for the Early plan (one user) to $78 for the Established plan (unlimited users), also offering a 30-day free trial. Each software provides unique features and pricing structures to cater to diverse business needs.

User Interface

Fine-tuned usability is important for user satisfaction, especially in accounting software. The software solution should be designed to be easy to use but should bring the best set of features that eliminate wastes of time and resources to its users. Arguably, first and foremost, a well-developed functional design is a precondition for a positive user experience and optimized effectiveness. Good software promotes a feeling of smoothness and the ability to use resources as tools in the process since the interface and interaction with the software are consistent and efficient, allowing for fast throughput. Best practices include a simple, consistent interface and hierarchical layouts.

Conclusion

Lastly, the option depends on your business needs, scalability, and desired balance between customization, usability, and setup. Regarding accounting software comparison, Odoo, Xero, Sage, and Quickbooks are excellent professional accounting solutions. These systems are suitable for complicated organizations due to their superior accounting features; they also provide accurate solutions for all accounting needs. Thus, Odoo could be precisely what you need if your needs are more extensive. Its superior features allow it to be used in any process. Its ability to be customized and the availability of its vast array of integrated business software make it the best suited to companies that have needs that extend beyond that of an accounting program. The structures of Odoo make it perfect for small to medium organizations because it is easy to use and install compared to other ERP software.